parker county tax assessment

Denver County collects on average 054 of a propertys assessed fair market value as property tax. Parcel number is 440-000-CD-81S the property is located in Penn Township 44 and the tax collector is Karen Little.

The median property tax in Denver County Colorado is 1305 per year for a home worth the median value of 240900.

. Public Property Records provide information on homes land or commercial properties including titles mortgages property. This is the Grant County Wisconsin Land Records Web Portal. If you need to pay your taxes for the 2nd installment period or past due taxes please visit this link.

Guadalupe County Assessor 420 Parker Ave Suite 3 Santa Rosa NM 88435 Phone 575472-3738 Fax 575472-3735. Many Texas county tax offices and appraisal districts have chosen SDS to be their technology partner. Our goal is to provide the most innovative and efficient solutions in the Texas local government arena.

Oklahoma Countys webpage has earned international awards and is one of the most popular with Oklahomans interested in the official Assessor records. This site works best with Internet Explorer 9 and above Chrome or FireFox. Point Pay Tax Payment Portal.

Realtors and citizens rely on for accurate ownership and assessment of value and other records available without charge-24 hours a day-7 days a week-365 days a year. We automate the tax collection and assessment processes that improve human performance and decision making. Tax Collectors The following is a listing of York Countys tax collectors for our 72 townships and boroughs.

Let SDS help optimize and. Colorado is ranked 1023rd of the 3143 counties in the United States in order of the median amount of property taxes collected. Parker County Property Records are real estate documents that contain information related to real property in Parker County Texas.

Search Dona Ana County property tax and assessment records by address property owner name account number parcel number map code and more. 2022 DEVNET Inc. The number by the name of the township or borough corresponds with the first two numbers in the parcel number for example.

Your 2020 Cook County Tax Bill Questions Answered Medium

Financial Risk Assessment Template New Financial Risk Assessment Template Illwfo Schedule Template Guided Reading Lesson Plans Internal Audit

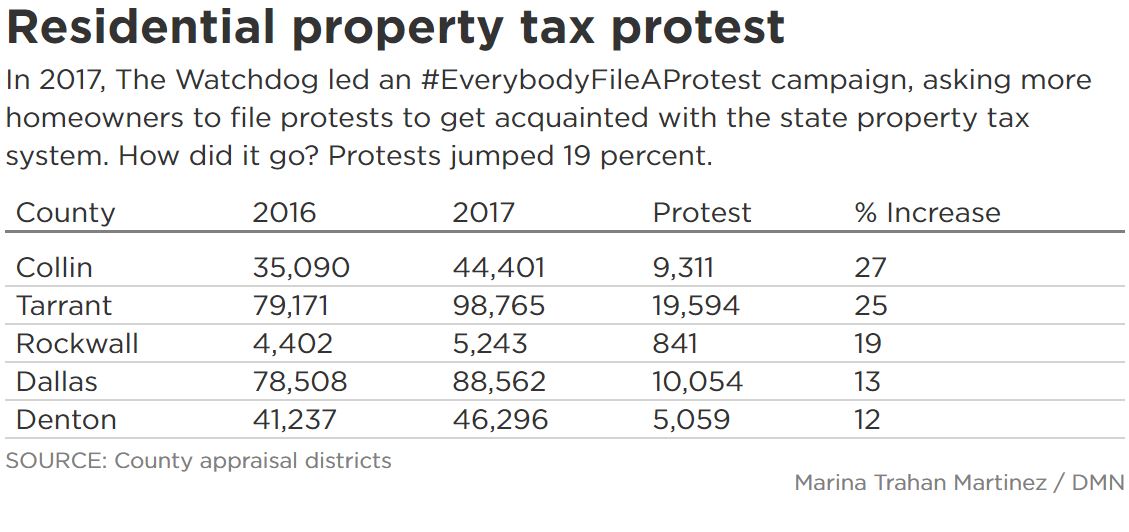

Why Are Texas Property Taxes So High Home Tax Solutions

Property Tax Alert What Does Land Value Mean For Your Taxes Watchdog Curious Texas Can Tell You

Here S A New And Inexpensive Way To Get Help Protesting Your 2018 Property Tax

The Property Management Module Lets You Centrally Store Track And Maintain Information And Documentation F Property Management Management Facility Management

Property Tax Calculation Boulder County

What Property Owners Need To Know About Homestead Savings Runnels Central Appraisal District Official Website

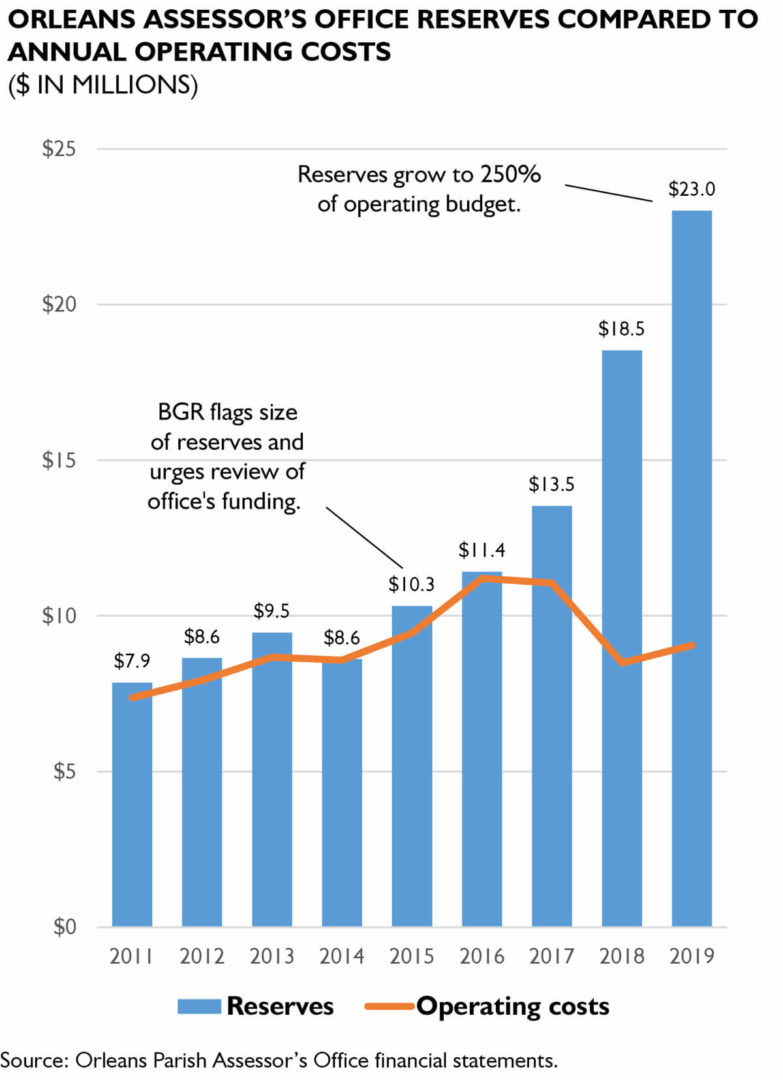

Policywatch Revisiting Assessment Issues In New Orleans

A Guide To Your Property Tax Bill Alachua County Tax Collector

Law Amends Property Assessed Clean Energy Pace Programs In Virginia Jd Supra Assessment Renewable Energy Energy

Property Tax Alert What Does Land Value Mean For Your Taxes Watchdog Curious Texas Can Tell You